How to prepare for a recession and thrive afterward

Tue | March 2023

Around mid-2021, we started seeing costs increase worldwide, and some places saw prices climb faster than they had in a long time. The U.S. was one of them, with prices rising 7.7% in October 2022 – the highest since 1982. Some experts say we could be heading for a rough patch in the economy, or a 'recession,' in 2023.

So, what's a recession? Picture it like a big economic dip that sticks around and leaves a lasting impact. It might only last a few months, but it can take years for things to get back to how they were before. For instance, the last big recession we had in the U.S., from December 2007 to June 2009, led to nearly 1.8 million businesses closing and many people losing their jobs.

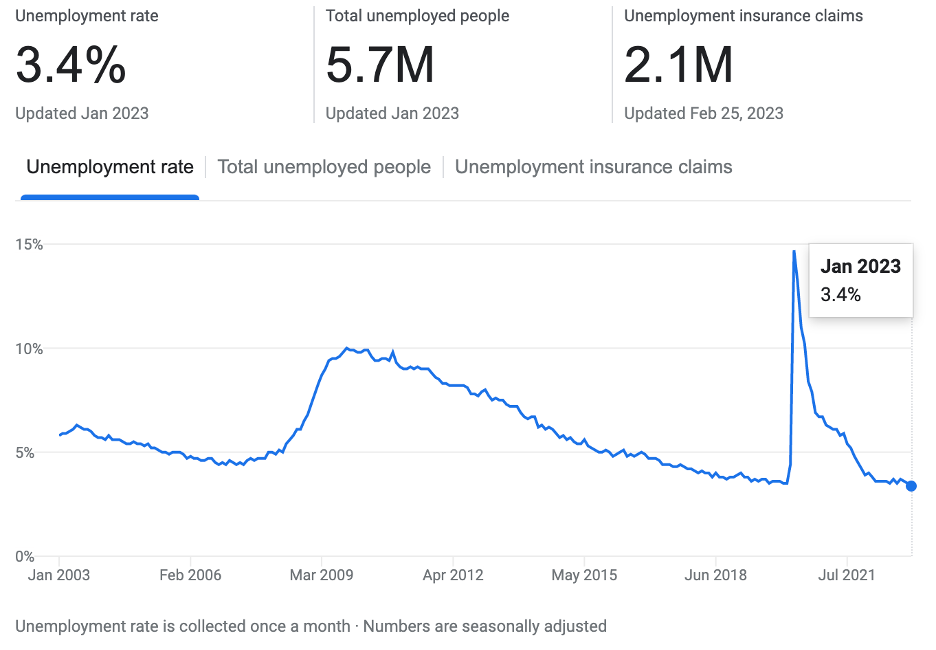

But here's the thing - the usual warning signs aren't as clear this time. Even though there's talk of a possible recession, the unemployment rate is still at a record low (see the line chart below). So, it's hard to say what will happen with the economy.

Despite this uncertainty, there's no need to panic. Instead, you can get prepared. After all, the right moves now can help soften any potential blow a recession might deliver. So, let's roll up our sleeves and dive into some practical strategies to prepare for whatever the economy throws at us next.

Image source: U.S Bureau of Labor Statistics.

Image source: U.S Bureau of Labor Statistics.

Ways you can financially prepare for a recession

Recessions are just a part of the economy, and with 2023 looking shaky, it's normal to be worried. But don't stress - you're not the only one wondering how to prepare for a potential downturn. If you do a quick Google search, you'll see that many people are in the same boat.

Luckily, we're here to help. We will give you some easy-to-follow tips that can help you prepare. This includes making a budget, starting an emergency fund, finding new ways to earn money, and cutting back on spending where possible.

1. Build an emergency fund

An emergency fund is a separate bank account used to offset the expense of an unforeseen situation, such as a job loss, medical emergency, or home repair. For example, an FDIC-insured account can provide financial security and peace of mind during difficult times, including unemployment. Therefore, if you lose your job and your bank fails, you can be assured that the FDIC will cover your deposits up to the insured amount, currently $250,000 per depositor, per insured bank.

You can also plan a budget to help you identify areas where you can cut back on expenses, prioritize your spending, and build a financial cushion to help you weather any economic downturn. To create your financial cushion, you can start by calculating your fixed monthly payments, which may include the following:

Rent or Mortgage

Public services

Food expenses

Gas and transportation

Other essential expenses

Once you have calculated your fixed expenses, focus on saving at least three to six months of their total. However, the ideal is to aim for a larger emergency fund if you have dependents or a greater risk of loss of employment.

2. Cut off unnecessary expenses

You likely have expenses you can do without or that are optional. If that is the case, we recommend that you make a list of your expenses in order of priority and spend your money in order of relevance. You can prepare a budget and track your expenses automatically in Excel. If you follow your spending and keep it within budget, there's less chance you'll fall into debt during a recession.

On the other hand, to eliminate unnecessary expenses, look for areas where you can reduce non-essential expenses, such as eating out, impulse purchases online, and subscription services, among other fees. Consider reducing transportation costs by carpooling or using public transportation.

Cutting back on your unnecessary and impulsive spending can help you lower your monthly expenses and help you prepare for a potential recession. You will have to make some sacrifices in the short term, but this will bring you financial security for a long time.

3. Diversify your income

By having multiple income streams, you can reduce your reliance on a single source of income and provide a more stable financial foundation, mainly when job security may be uncertain. The following are some ways you can diversify your income during a recession:

Look for freelance opportunities, including writing, graphic design, web development, or tutoring services. You can also sell products online or start a small business.

Consider renting a spare room or property on platforms like Airbnb or VRBO.

Try investing in stocks, bonds, or real estate.

Start a blog or create content if you enjoy writing.

Taking online courses or attending workshops to learn new skills.

Diversifying your income during a recession is a smart strategy to help you protect yourself financially, so start developing passive income ideas now.

4. Manage debt wisely

Debt is a tricky thing. Economies run on debt. However, a potential recession calls for a more innovative way of handling old and new debts. Ensure you don't unwisely borrow money or co-sign a loan without giving it some real thought. With the Federal Reserve hiking up interest rates, money is more expensive for the banks, and guess who pays for that? You do, so borrow wisely; borrow to grow and ensure you are ready to pay your debt.

With that said, if you are a sole proprietor of a business or run a small business and you have the means to create revenue, do not hesitate to find the working capital financing you need to engage in that growth. Economic uncertainty also tends to make the opportunity; if you have it, and you know you do, don't be scared to leap.

5. Look for investment opportunities

Looking for investment opportunities during a recession can be challenging, but it can also be an excellent time to find undervalued assets that generate long-term returns. First, evaluate the economic landscape and look for industries or sectors likely to benefit from a recovery, such as healthcare or technology. Similarly, there are various investment options, such as the following:

Low-risk investments like Certificates of Deposit and money market accounts.

Medium-risk investments like corporate bonds

Higher-risk investments like stock index funds.

Remember that any investment carries risk, and assessing the risk before deciding where to invest is vital. Look for investments with a favorable risk-to-reward ratio and avoid overly speculative or high-risk investments. You can look for companies or assets with strong fundamentals, such as a solid balance sheet and a history of stable earnings.

Finding investment opportunities during a recession requires careful evaluation, a long-term focus, and a willingness to take calculated risks. As an investor, you can seize opportunities that generate long-term returns by assessing the economic landscape, evaluating risk, looking for undervalued assets, focusing on quality, and considering dollar-cost averaging.

6. Enhance your skills and knowledge

No matter where you are in your career, continue to develop your skills and knowledge. Investing in training is a good investment. When the recession ends, and the economy returns to normal, companies will likely want to hire new staff. If you invest in learning new skills and having a unique experience, you can change jobs or get a job that pays better.

Many online resources are available, such as online courses, tutorials, and webinars. Some of the most popular online platforms include Coursera, edX, Udemy, and LinkedIn Learning, among other platforms.

7. Take advantage of government tax credits and deductions

The government always introduces initiatives to get people and businesses to cushion the effect during and after economic hardships. In addition, there are also tax benefit programs.

Look up incentives and qualification requirements and apply if you meet them. It can be about affordable housing, low-interest business loans, reduced Medicaid costs, etc. They can also be tax incentives for energy savings, tax benefits for education, or childcare expenses. You can visit the USAgov page to find more information.

Start planning today!

Planning for the worst-case scenario is the first step to surviving a recession. Create an emergency fund, pay off high-interest debt, live within your means to the best of your ability, diversify your investments, and make long-term investments. It would help if you also looked for a side job to maintain income once a recession hits.

So what are you waiting for? Nothing stops you from creating a plan to prepare and survive a recession.

Disclaimer: The content of this post has been prepared for informational purposes only. It is not intended to provide and should not be relied on for tax, legal, or accounting advice. Consult with your tax, legal, and accounting advisor before engaging in any transaction.